Department Of Education And Instruction Victoria

In common, classrooms have the identical little ones and the same teachers each and every day. Thus, because a parent’s time is spent at a location of perform to earn…

Education Technology Options

Social believed is as old as society itself, yet the origin of sociology is traced back to 19th century Western Europe. Excellent function!!!!it is indeed excellent to live with excellent…

Florida Department Of Education

In general, classrooms have the exact same youngsters and the very same teachers each and every day. Most of the time individuals that discover this alternative have households and are…

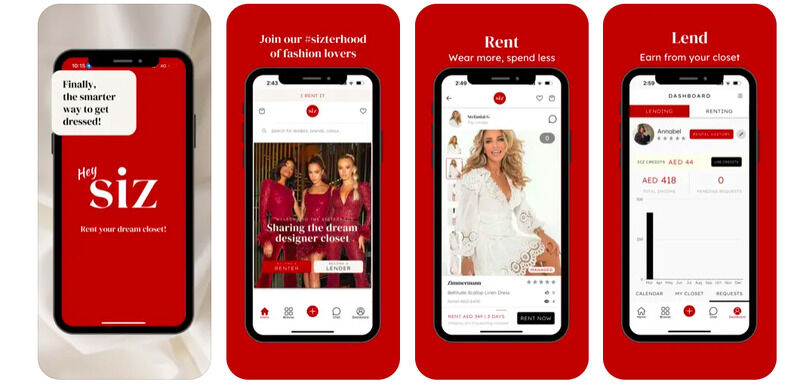

P2P Clothing Rental Platforms : Sizters: Rent & Lend Fashion

Sizters: Rent & Lend Fashion introduces a new concept to the UAE’s fashion scene with its peer-to-peer rental platform. By facilitating the sharing of designer clothing, Sizters aims to redefine…

조선일보Korea's auto components industry decreases reliance on Hyundai Motor, diversifying business partnersKoreas auto components industry decreases reliance on Hyundai Motor, diversifying business partners South Korean automotive parts….1 day ago

조선일보Korea’s auto components industry decreases reliance on Hyundai Motor, diversifying business partnersKoreas auto components industry decreases reliance on Hyundai Motor, diversifying business partners South Korean automotive parts….1 day ago link…

Northeast Mississippi Daily JournalThe 10 WORST Things To Happen To Princess Zelda | Arts & Entertainment | djournal.comAnd here we thought Link had a rough time. Welcome to MojoPlays, and today we're looking at the worst things to ever happen to Princess….4 hours ago

Northeast Mississippi Daily JournalThe 10 WORST Things To Happen To Princess Zelda | Arts & Entertainment | djournal.comAnd here we thought Link had a rough time. Welcome to MojoPlays, and…

OHHS poised for “Little Shop of Horrors” production | Arts & Entertainment

oak hill – “Feed me, Seymour.” The Oak Hill High School Theater Department will present the Broadway version of “Little Shop of Horrors” during the May 3-5 weekend. According to…

“Challengers” Is Jonathan Anderson’s Love Letter to Normal Clothes

Tashi pairs her Loewe cotton shirtdress with Chanel espadrilles when she’s older, and wears Cartier jewelry exclusively (despite her real-life Bulgari ambassadorship). She applies Augustinus Bader cream on her body…

Beijing Motor Show 2024: all the key cars and why they matter

The electric G-Class wasn’t the only new Mercedes in Beijing either. There was the debut of the AMG GT 63 S E Performance – a plug-in hybrid which just so…